An alternative solution for a flawed Beltline tax proposal

This guest post was submitted by Kyle Kessler, Policy & Research Director for Center for Civic Innovation

EDIT: Council approved the Beltline tax on 3/15/2021. See the update at the end of the post for more info.

On its Special Service District (SSD) webpage, Atlanta BeltLine Inc. (ABI) states that the proposed Special Service District “is a targeted tax district where commercial and multi-family property owners pay slightly more in property taxes to fund the completion of the Atlanta BeltLine Trail.” Additionally, ABI’s FAQs state: “Owner-occupied residences, including single family homes, condos, and townhouses, will not be part of the SSD.”

However, if the intention is to protect single-family homeowners from a new tax, the current SSD parcel selection really misses the mark:

More than 16% of non-taxed parcels have an owner with a non-Atlanta address – including Australia, China, the United Kingdom, and the Virgin Islands.

Just 51% of non-taxed parcels have any homestead exemption.

Over 4,000 non-taxed parcels are owned by LLCs.

Meanwhile, over 7% of the parcels currently included in the SSD have homestead exemption!

Although single-family residences, townhomes, and condos are supposedly excluded from the district, according to the SSD map there are currently over 900 residential condominium/loft units shown as being taxed. (See Exhibit 1, bottom of post.)

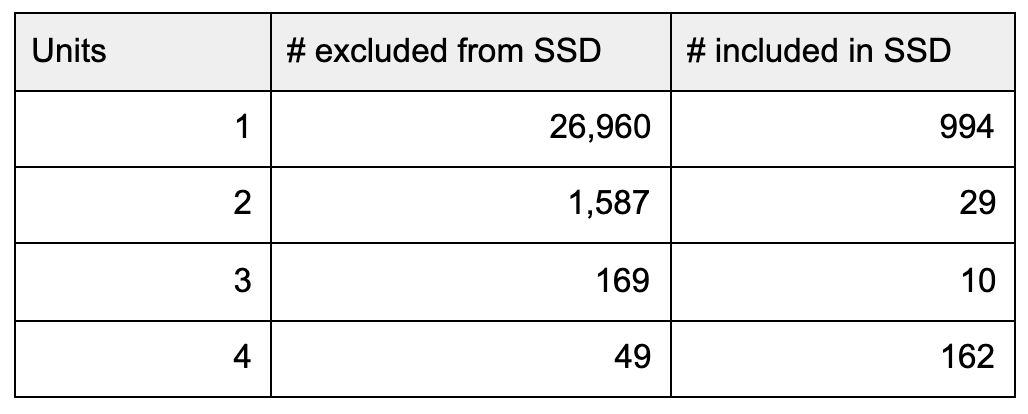

Additionally, the threshold between single- and multi-family and whether or not they’re taxed appears to be inconsistent from parcel to parcel. Some single-unit parcels (mainly the condos listed previously) are taxed while most are not. Duplexes and triplexes are generally excluded but quadruplexes are taxed more often than not.

Units included and excluded within the SSD

Units included and excluded within the SSD

Here’s just one example: two neighboring 4-unit dwellings located at 889 and 887 Vedado Way NE in Midtown owned by the same owner. One is taxed and the other isn’t.

Vedado Way homes

According to the latest Census estimates, 56.5% of Atlanta residents are renters. The SSD as proposed will likely lead to increased rents for residents who live in multi-family rental properties while placing no tax burden on a foreign investor who owns a single-family home.

Clearly, there are significant challenges with how parcels have been identified. But rather than engaging in minor adjustments to correct what are likely unintentional errors, an alternative solution could provide less complexity and more equity.

Alternative SSD

An alternative solution would be to include all parcels within the Beltline Planning Area and allow existing exemptions for homeowners, seniors, etc. to provide relief to qualified residents.

The current proposal is a 2-mill tax increase. ($2 for every $1,000 of assessed value). Based on approximately $3.2 billion in assessed value on non-exempt parcels currently identified as being in the SSD, that would amount to approximately $6.4 million annually.

To achieve the same $6.4 million but drawing from the approximately $7.8 billion in assessed value on all the non-exempt properties (commercial, industrial, residential, etc.) in the entire Beltline Planning Area and accounting for an approximately 50% reduction in value on homestead exemption properties, only a 1-mil property tax would be necessary.

This would cut in half the burden on small businesses and residents in multi-family properties whose landlords will most likely pass on the higher tax in higher rents. It will also have owners of single-family residences, condos, and townhomes – whether owner-occupied or not – help to pay their fair share, too.

Looking at Vedado Way (see Exhibit 2, bottom of post), the next two parcels are both single-family homes, but one (881) is owner-occupied and the other (875) is owned by an investment company.

Vedado Way alternate

Rather than the four tenants in just one of the buildings being taxed, the alternative SSD proposal would tax all these parcels. The per-unit cost would be lowest on the multi-unit buildings (their units are smaller). The lowest per-square-foot cost would be for the owner-occupied parcel because of homestead exemption. The highest per-unit and per-square-foot cost would be for the investor-owned single-unit building. This would be a much more equitable tax.

Exhibit 1

Residential condominium/loft units currently shown on the SSD map as being taxed

560 Dutch Valley Rd NE: Belvedere Condominiums

572 Edgewood Ave NE: Dynamic Metal Lofts

924, 925, 928, and 933 Garrett St SE: Glenwood Park

620 Glen Iris Dr NE: Ponce Spring Lofts

640 & 660 Glen Iris Dr NE: Glen Iris Lofts

1100 Howell Mill Rd NW: White Provision Residences

130 Krog St NE

563 Memorial Dr SE: Oakland Park Condominiums

898 Oak St SW: Sky Loft Condos

2233 Peachtree Rd NE: The Astoria at the Aramore

2285 Peachtree Rd NE: Peachtree Battle Condominiums

840 United Ave SE: The Enclave at Grant Park

587 Virginia Ave NE: Virginia Hill Condos

Exhibit 2

Vedado Way table

Update: Council has approved the tax as of 3/15/2021

The ordinance that was adopted by council was substituted (an amendment too big/substantial to just be an "amendment") at the 3/15/21 council meeting, authorizing the City's Chief Financial Officer to make "corrections" to the list of properties. According to what Council member Matt Westmoreland said during the meeting, it sounds like there are some pending zoning changes that'll take place before the tax goes into effect.

Over 900 residential condo parcels identified were incorrectly flagged as being in the SSD in the Beltline's map file. But, per the attachments to the ordinance, they were not actually proposed for inclusion in the district. There remain 12 commercial/industrial parcels in the SSD that have homestead that ABI has asked Fulton County to investigate.

Kyle Kessler is Policy & Research Director for Center for Civic Innovation, a non-partisan, 501(c)(3) nonprofit organization fighting to solve inequality in Atlanta. We inform and engage residents on the issue of inequality, invest in and amplify community solutions, and advocate for policy change. For more information, visit civicatlanta.org or @civicatlanta on social media.